Embrace Futuristic Technologies in Banking with TrustBankCBS

Increase control over your banking business and achieve desired growth, with 'TrustBankCBS Core Banking software'. Streamline key processes, gain greater insight into banking business, and make decisions based on real-time information – for higher efficiency and profitability.

'TRUSTBANKCBS Core Banking Software' gives you the unique advantage of implementing a single Banking Software seamlessly across the organization.

'TrustBankCBS Core Banking Software' Offers:

- Experience of Serving BFSI for 25+ Years.

- Ranked among top 30 core banking softwares.

- Footprint in 25+ Countries.

- Strong Global network of Sales & Services Parters.

- Agile approach: Flexibility of Localization & Customization.

- License Purchase As well As Software as a Service Model.

- 24 X 7 Banking Services with minimal Capex & Opex Cost.

TrustBankCBS Key Differentiators

We deliver complete solution and services stack under one roof. The key differentiators of TrustBankCBS, enables BFSI to excel competition with Technology and Business Advantages.

- Comprehensive Solution and Services Stack for BFSI under one roof.

- Integrated business intelligence.

- Integration with Digital Banking and Payments Systems.

- Quick Implementation, Best Industry Practics.

- Open Architecture with API.

- Configurable & Parameterized Workflow.

- 360 Degree customer view and configurable KYC/ CIF, CRM and more

- Multi-currency, multi-lingual

- Inclusive Reports Configurator, Reports Builder

- Complete KYC Compliance, AML Compliance, Statutory Compliance.

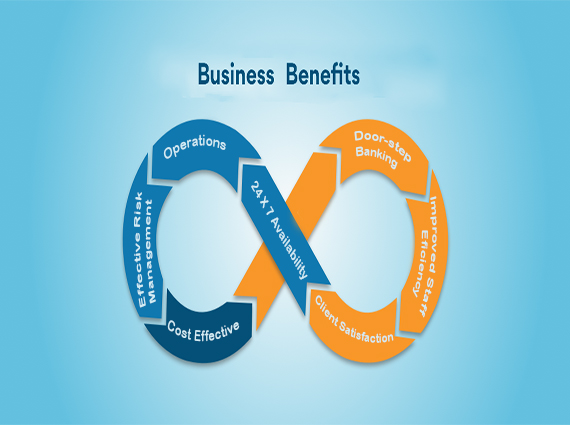

TrustBankCBS Benefits to BFSI

Continual upgradations in TrustBankCBS Platform, enables BFSI to adapt to latest technologies, delivery channels and emerging products and services.

Comprehensive TrustBankCBS Solution enables banks to streamline operations, reduce operations & support cost to provide below benefits:

- A 360 degree view of Branch and Bank operations; Quick Decisions

- Introduction of Strategic and Profitable Products, Services

- Cost Effective & Efficient Operations; Maximum utilization of Resources

- Reduction of Revenue Leakages; New Revenues Opportunities

- Minimize Operations & Support Cost; Assured ROI & Profitability

- Improved Customer Satisfaction and Retention

- Improved Staff Efficiency and Motivation

- Effective Risk Management & Statutory Compliances

Find out more about TrustBankCBS Software

Core Banking Software for BFSI Segments

BFSI across multiple business segments globally, have leveraged the TrustBankCBS comprehensive solution stack, to automate and seamlessly integrate its business functions. TrustBankCBS Agility have facilited customizations to provide localized and segment specific solutions to BFSI.

Co-operative Banks

Maximize revenues, Minimize Leakages, Boost Profitability and Customer Satisfaction.

Micro Finance

Mobility Solution with Core Functions transforms the Micro-Finance from complex to simple.

Small Finance Banks

Deliver unique solutions and services to customers to achieve competitive advantage.

Core Banking Software Solutions

TRUSTBANKCBS is a Robust, Secured, Integrated-yet-modular core banking solution. It provides a single, unified platform for its Core, Add-on Modules and interfaces with uniform browser based, user friendly UI.

Interested In TrustBankCBS?

Comprehensive Solutions with Unmatched Business Functionality

All SolutionsKnow Your Customer

Seamless solution for customer onboarding and KYC Compliance.

Loans Management

Mobile & Web based System; Ensure Checks, Credit Scoring & quick turn around.

Deposits

Configurable Solutions to offer attractive deposit products to market.

Digital Banking

Technology innovations for complete digital services experience to Bank's customers.

Statutory Compliance

Predict, measure, manage risk; & ensure statutory compliance.

Business Intelligence

Realizing the full potential of BI for rise in efficiency & profitability.

Core Banking 'Software as a Service'

TrustBankCBS offers off-the-shelf banking software functionality, on 'Software as a Service’, i.e. bundled solution of Application Software and Hosting Infrastructure on rent, to growing BFSI organizations. The SaaS platform allows the BFSI leverage the end-to-end business functionality in TrustBankCBS, with almost zero Capex Cost, economical Opex cost and assured High Up-time of Core Banking Application. The pre-configured ‘Bank In a Box’ functionality, Best Industry practices in Implementation, and Punctual Technical support, facilitates quick Go-live and Business Scalability with TrustBankCBS SaaS.

TrustBankCBS being a Truly Browser Based Software, is a natural choice for SaaS platform. The Browser Based TrustBankCBS on Cloud, is managed and maintained by TrustBankCBS team for rich functionality upgrades, statutory compliance upgrades and technology upgrades for Infrastructure THUS relieving Banks from challenging task of Application & Infrastructure Maintenance.

Read More00

+ Clients00

+ Countries00

+ Partners00

+ Team MembersTestimonials

Insights

Check out the developments at TrustBankCBS. Gain expert views and insights on innovations, technology and changing Core Banking landscape. Access TrustBankCBS Solution videos and Brochures for complete overview.

News, events and press releases related to TrustBankCBS on topics of Core Banking, Technology, latest trends in banking.

Knowledge, Experience, Innovations in Banking shared by experts in Banking and Financial Services sector.

Find out how Banks achieves efficiency, return-on-investment, customer satisfaction with best core banking software.